- Course

Implementing Monte Carlo Method in R

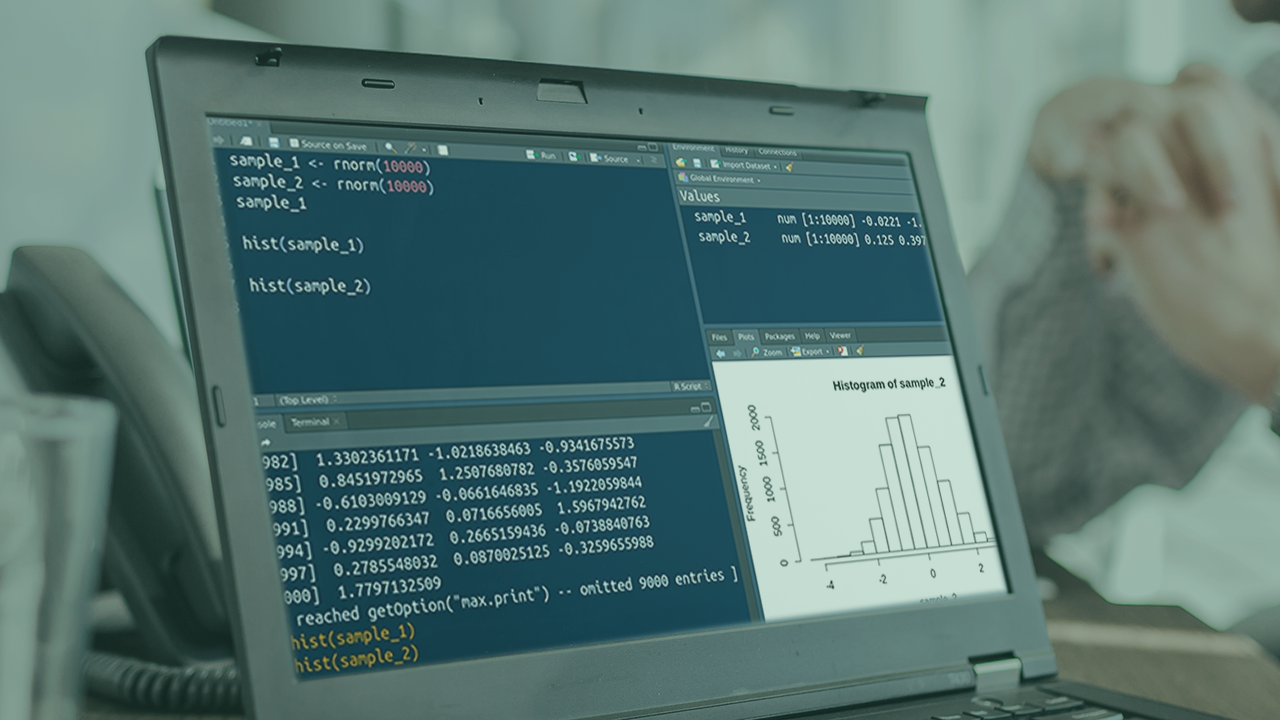

Some problems are difficult or impossible to solve with standard mathematical or statistical approaches - these can often be solved by using the Monte Carlo method. This course covers multiple Monte Carlo applications for ready use.

- Course

Implementing Monte Carlo Method in R

Some problems are difficult or impossible to solve with standard mathematical or statistical approaches - these can often be solved by using the Monte Carlo method. This course covers multiple Monte Carlo applications for ready use.

Get started today

Access this course and other top-rated tech content with one of our business plans.

Try this course for free

Access this course and other top-rated tech content with one of our individual plans.

This course is included in the libraries shown below:

- Data

What you'll learn

Repeated sampling using the Monte Carlo method can be a much more efficient approach in solving difficult problems vs. standard mathematical or statistical practices. In this course, Implementing Monte Carlo Method in R, you’ll gain the ability to build your own Monte Carlo simulations using a variety of approaches and know which solution is most effective. First, you’ll explore the basics behind Monte Carlo and the fundamental functions in R. Next, you’ll discover some simple methods, followed by simulations on stock and commodities data for estimating return probabilities. Finally, you’ll learn how to use Monte Carlo methods on A/B tests. When you’re finished with this course, you’ll have the skills and knowledge of Monte Carlo methods needed to implement these methods yourself.