- Course

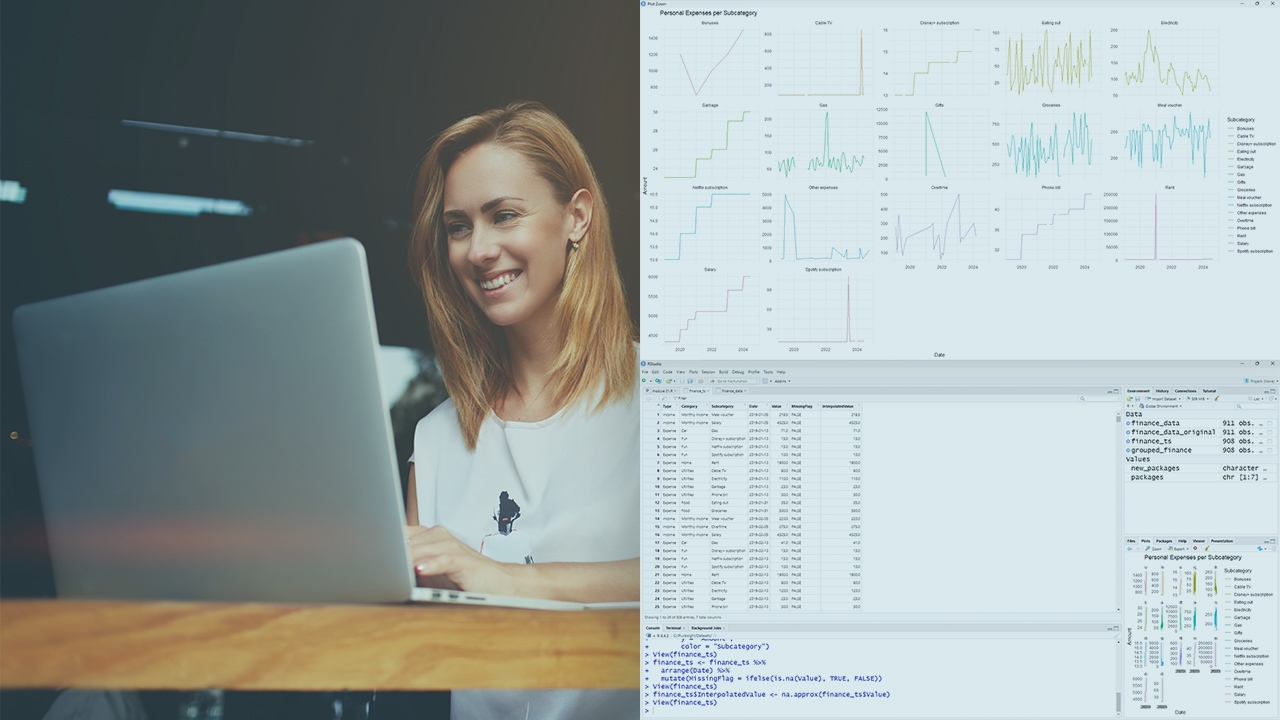

Time Series Analysis and Forecasting in R

Learn how to analyze and forecast financial trends using R. This course will teach you how to build time series models to predict income, expenses, and savings, helping you make smarter financial decisions with data-driven insights.

- Course

Time Series Analysis and Forecasting in R

Learn how to analyze and forecast financial trends using R. This course will teach you how to build time series models to predict income, expenses, and savings, helping you make smarter financial decisions with data-driven insights.

Get started today

Access this course and other top-rated tech content with one of our business plans.

Try this course for free

Access this course and other top-rated tech content with one of our individual plans.

This course is included in the libraries shown below:

- Data

What you'll learn

Many individuals and businesses struggle with predicting financial trends, managing cash flow fluctuations, and making data-driven financial decisions. Without proper forecasting, unexpected expenses, income variability, and poor savings planning can lead to financial instability.

In this course, Time Series Analysis and Forecasting in R, you’ll gain the ability to analyze time series data and build forecasting models to predict financial trends.

First, you’ll explore the fundamentals of time series data, including identifying trends, seasonality, and stationarity in financial transactions.

Next, you’ll discover how to build and evaluate forecasting models such as ARIMA, ETS, and Prophet to predict income, expenses, and savings.

Finally, you’ll learn how to fine-tune models, diagnose errors, and effectively visualize forecasts to provide actionable financial insights.

When you’re finished with this course, you’ll have the skills and knowledge of time series analysis in R needed to confidently forecast financial trends and make smarter financial decisions.